For 2026, the Minnesota Star Tribune will continue to offer the PPO and HSA Plans administered by UMR and the Surest Plan.

Each year, we strive to offer benefits to you and your family that provide protection with choice and flexibility. We hope that you will see our commitment to you and your family by providing benefits that are inclusive, supportive, and responsive to your health and wellbeing.

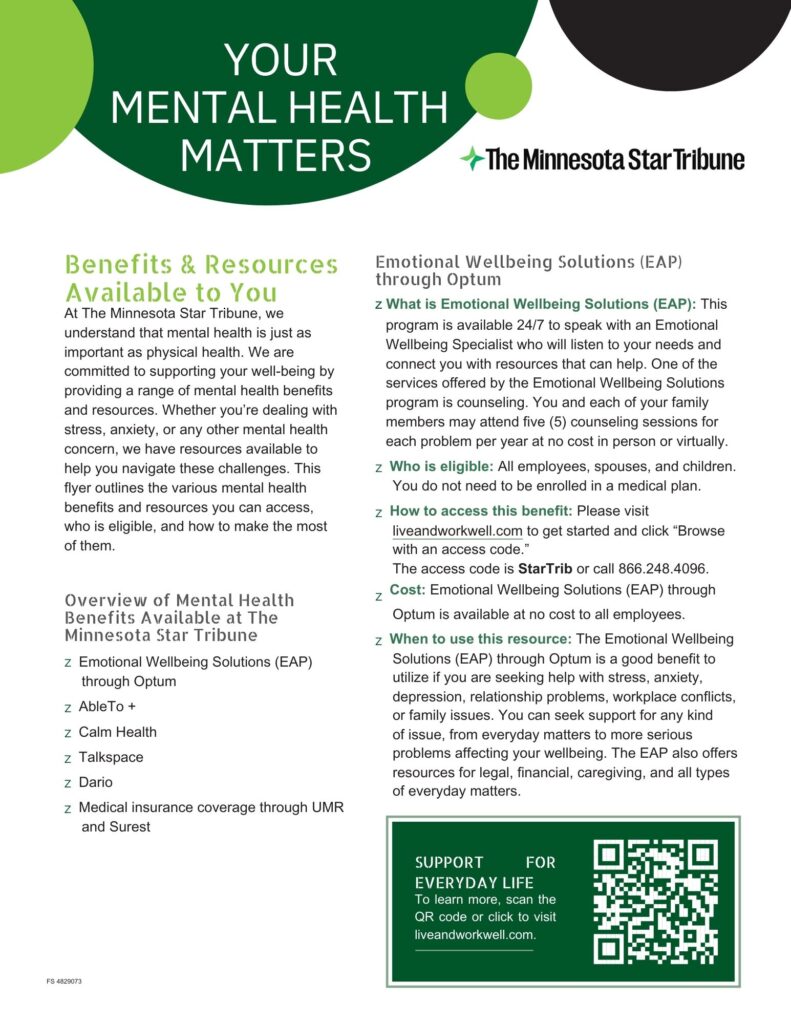

- Reflective of this commitment, we added Dario Health, a healthy living program to offer resources and care for those dealing with chronic conditions, such as diabetes, hypertension, weight management, muscloskeletal and mental health.

- We also offer a wellness program, with a reduced monthly premium for PPO and the Surest plan, or a higher HSA employer contribution for completing the program.

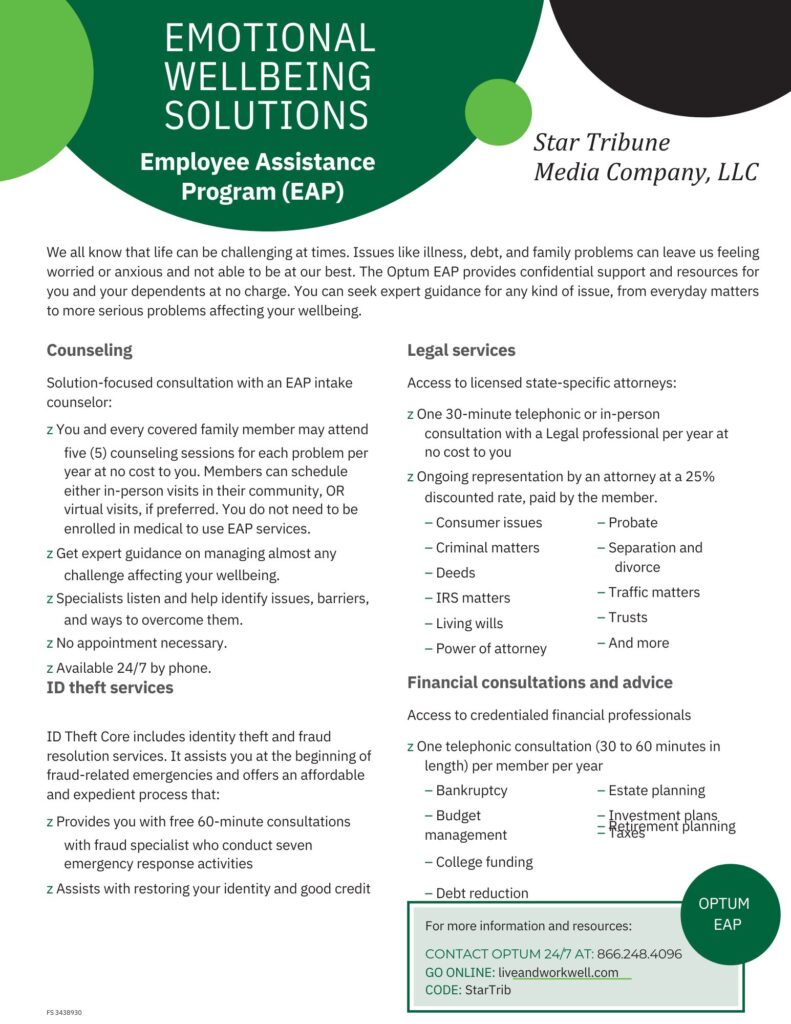

- In addition to the core benefits of medical, dental, vision, life and long-term disability, our benefits package include paid time off, 401(k) match, commuter benefits, EAP, and career development through LinkedIn Learning and tuition reimbursement

2026 Open Enrollment Presentation

2026 Benefits Highlights – What’s changing?

- Changes to our medical premiums, deductibles, co-insurance, and out-of-pocket maximums, and overall cost sharing percentages.

- Telehealth

- The HSA medical plan will now allow for telehealth (general medicine, dermatology, and behavioral heath) visits to be covered by a $15 copay before meeting the deductible. The PPO medical plan already offers this benefit.

- Flexible Spending Account (FSA):

- The Dependent Care FSA maximum contribution amount will increase to $7,500 from $5,000

- The Medical FSA is increasing to $3,400 from $3,200 for 2026

- Health Savings Account (HSA):

- The 2026 individual contribution is $4,400 and the 2026 family contribution is $8,750

Since all the medical plans cover the same type of health care services, you’ll want to pay attention to differences in coverage for in-network providers and out of network providers, your biweekly rates, and some of the set amounts that you will pay out of pocket up front such as prescription copays, deductibles, coinsurance, and copays in the Surest plan. You’ll want to consider the health care needs of you and your eligible dependents.

If you participate in the Minnesota Star Tribune Wellness program, you can further reduce your out of-pocket costs.

Click on the links below for Plan information:

- 2026 Medical Plan Comparison

- 2026 Summary of Benefits and Coverage – Surest

- 2026 Summary of Benefits and Coverage – PPO

- 2026 Summary of Benefits and Coverage – HSA Plan

- Health Savings Account HSA

- Flexible Spending Accounts

- Coverage for Spouse and Adult children

- Before-Tax and After-Tax Premiums

Eligibility/Mid-Year Changes

Additional Benefit Plans

Please refer to the menu across the top of this page for detailed information on your other benefit plans.

Contact Information

At the Star Tribune, you may email benefits@startribune.com or call the benefits hotline at (612) 673-7458.